A few weeks ago I shared with everyone the set-up in my main planner—the A-5 filofax . See the full post Here. I use that planner to coordinate most of the personal aspects of my life including goals, master task lists, project planning, travel, and all kinds of planning for family activities. However, I like to sit down with a separate budget planner at least twice a month and try to get my financial house in order.

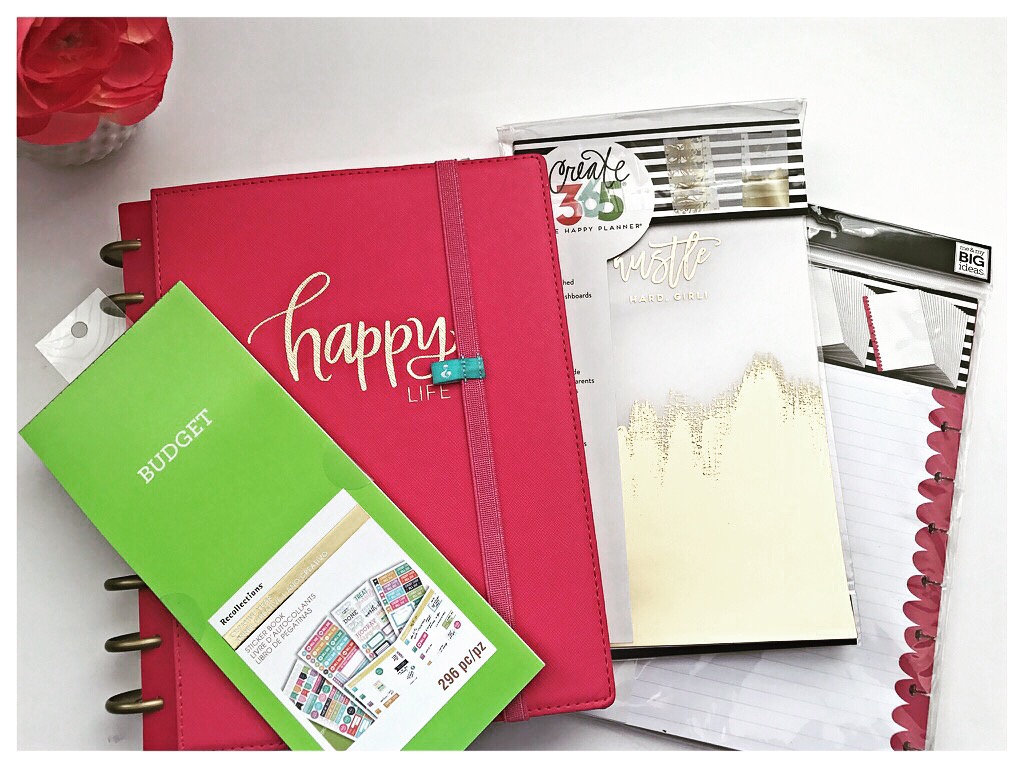

The Happy Planner has a separate budget planner and budget planner inserts and extension packs that can be very useful. I use The Happy Planner covers and inserts for most of my budget planner. This post includes a walkthrough of the planner I just set up with all new inserts for 2018 and how I plan to use them.

I purchased this cover separately from Michael’s last year along with all the supplies you see. The Happy Planner sells many different cover options you can use with your inserts if you want to upgrade a little bit.

I use these pockets to hold important bills that need to be paid, especially random medical bills, annual insurance payments, HOA fees, etc. Basically any type of random non-recurring payments that I don’t pay online.

I also purchased these dashboards made by the Happy Planner from Michael’s. I use the Carpe Diem tabs to label them: Budget, Calendar, and Notes.

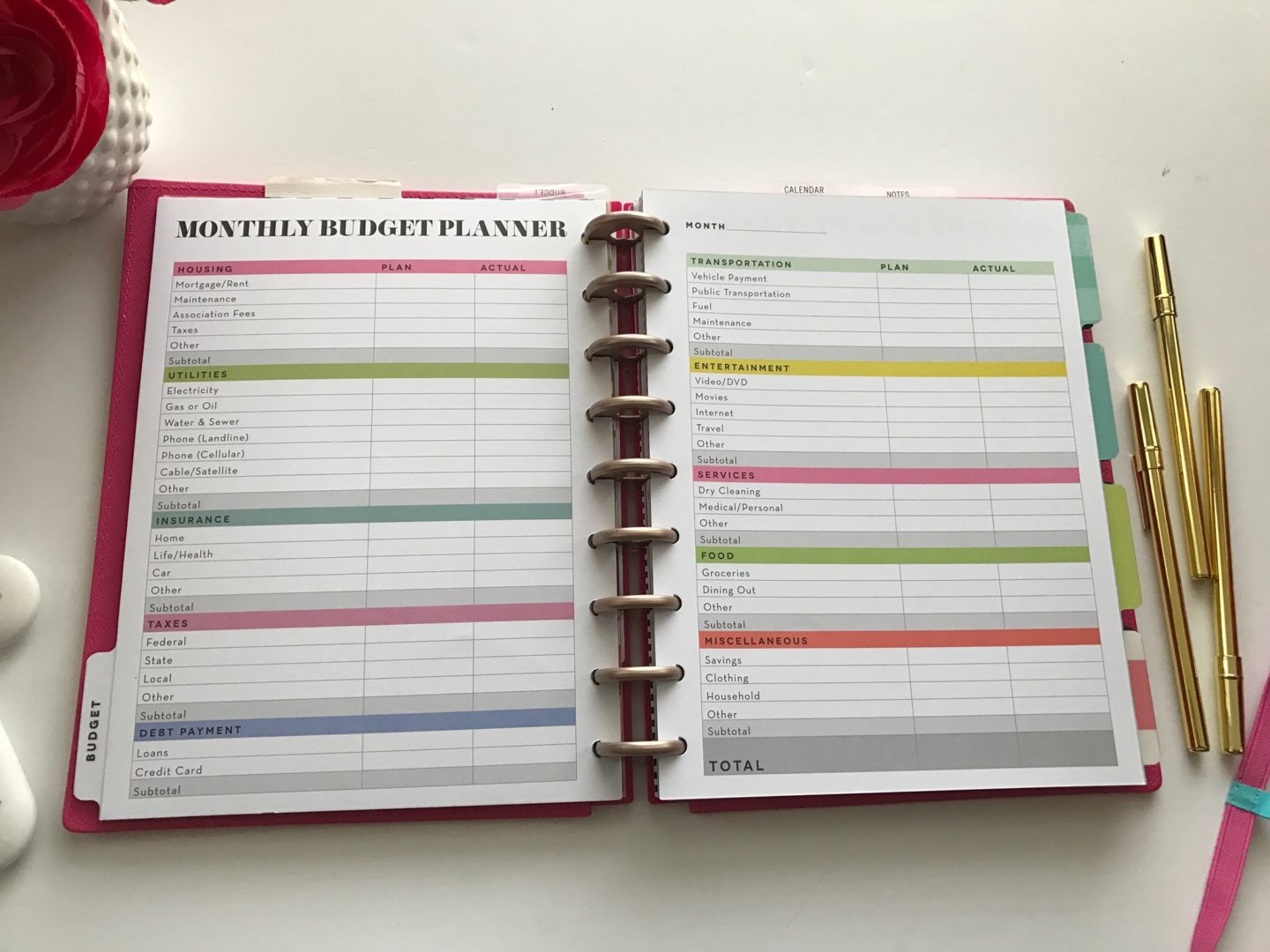

I like to use these full page monthly budget planners to lay out my budget each month. There are twelve of these in the planner.

So, let me just say right now I do not use the expense tracker. I really don’t have the time to sit and track all my expenses in that type of detail. I prefer to use excel and electronic apps for that. I do however, like the budget review sheets.

One of the things I like to keep track of in the Budget review section are some of my financial goals. One of my 2018 goals for this year is Obtain Financial Peace. That means more broadly to have all my financial house in order so that everything is on auto-pilot and I sleep good at night—sufficient emergency savings, adequate insurance to guard against risk, and appropriate funding in my 401K plan for retirement. I then have this goal parsed down to smaller goals including :

- complete my 2017 taxes

- set up a financial binder for the family with all our important data

- perform an updated investment analysis

- evaluate and increase as necessary 401K funding

- get a credit card to use just for internet purchases only

If getting your financial house in order is one of your 2018 goals this year, check out these great goal action ideas for finance goals from Cultivate What Matters: FInance Goal Action Ideas.

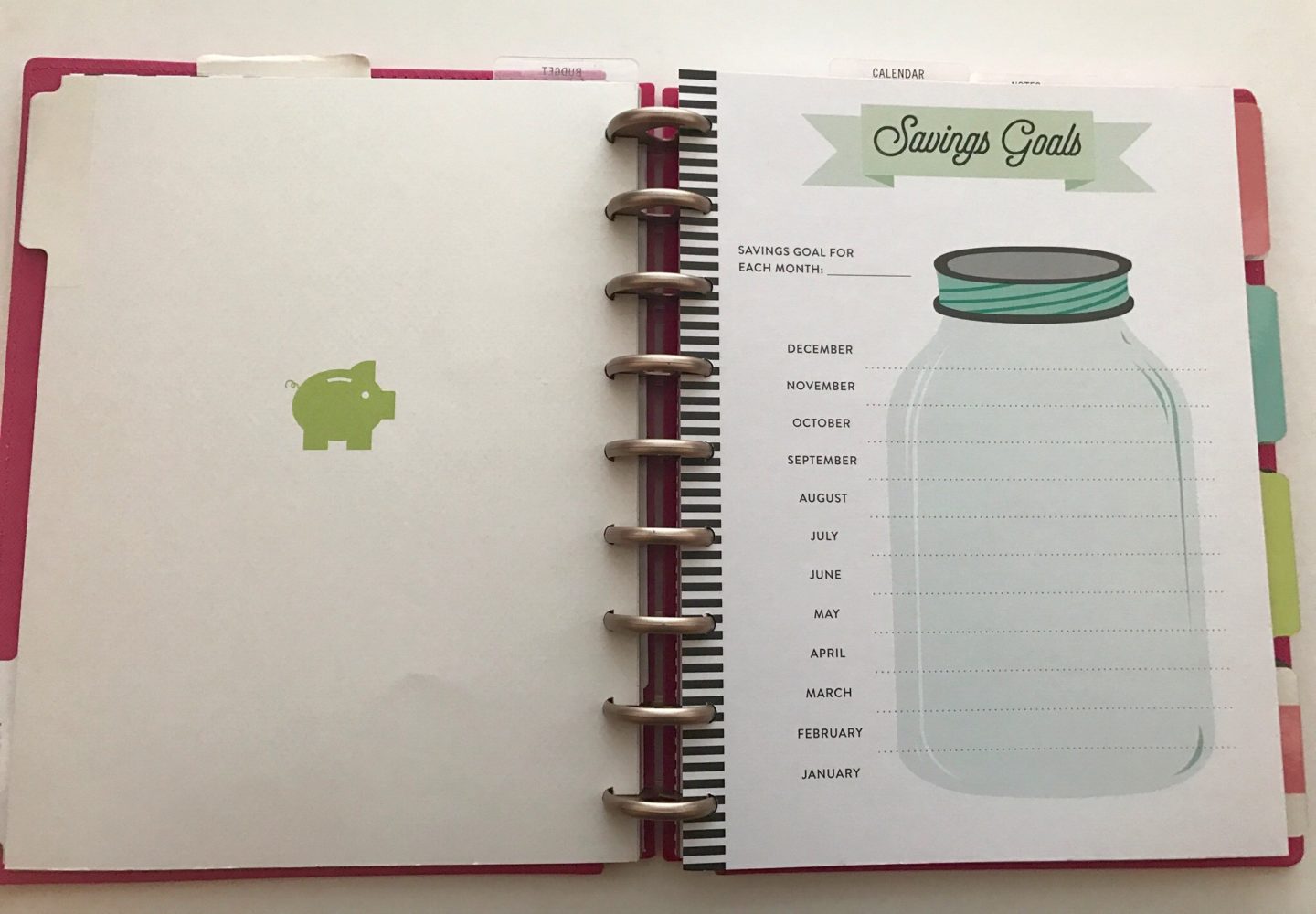

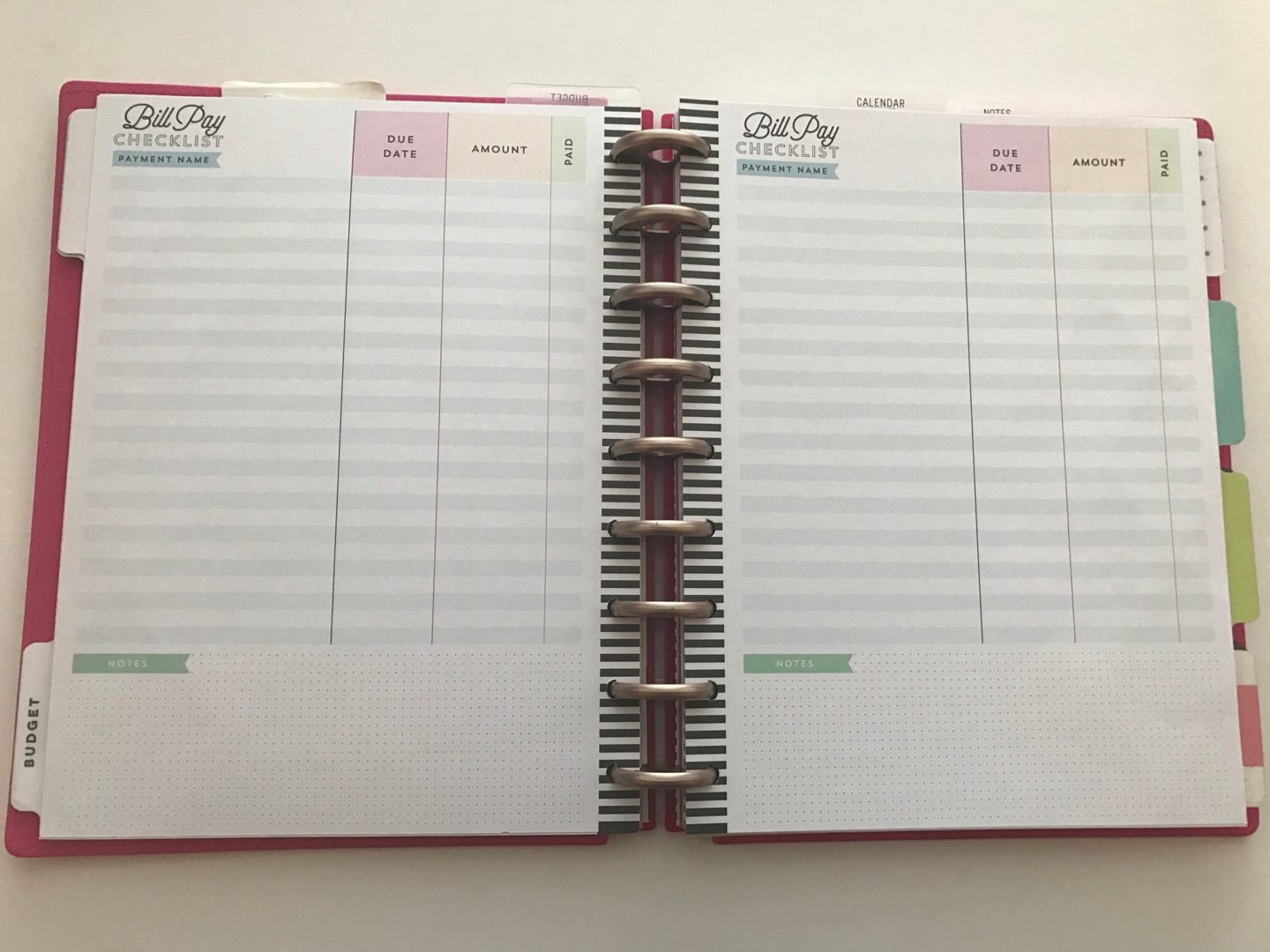

There is also a savings log and a bill-pay checklist.

And finally, In the Calendar section, I just keep the monthly calendar inserts in the planner. I use these to track all my bill payments. And I use the Notes pages for various catch-all planning and information. I keep there lists of all my annual bills and all my auto debit recurring transactions.–this is very handy if you have to cancel or change your debit card. It’s just really nice to have everything in one spot for my financial planning and bill-paying.

Happy Planning!

Brenda